While Wallester provides a popular platform for corporate expense management, some businesses may find themselves looking for alternatives due to specific limitations or needs. This article will explore what Wallester offers, examine the reasons you might consider a different provider, and present other global payment solutions to help you find the right fit.

What is Wallester?

Wallester is a financial technology company that specializes in corporate expense management solutions using virtual and physical Visa cards. The platform provides features like real-time expense control, detailed financial reporting, instant virtual card issuance, and multi-currency support.

They offer a free plan that includes up to 300 virtual cards, with premium plans available for businesses with greater needs. While users on Trustpilot rate the platform highly for its user-friendly interface, some have reported challenges with integration and technical support.

What to Consider When Selecting a Wallester Alternative?

When searching for a Wallester alternative, several key factors can guide your decision-making process:

- Pricing and Fees: A clear breakdown of monthly, transactional, and foreign exchange fees is essential for managing your budget.

- Global and Crypto Capabilities: Consider whether the platform supports multi-currency accounts, international transfers, and digital asset conversions for borderless operations.

- Integration with Existing Tools: Check for compatibility with your accounting software and other business systems to ensure smooth financial workflows.

- Card and Expense Controls: Evaluate the platform's features for issuing virtual and physical cards and setting spending limits to manage team expenses effectively.

- Customer Support Quality: Look into the responsiveness and expertise of the support team, as reliable assistance is vital for resolving financial issues quickly.

If these considerations resonate with your business needs, explore the top alternatives we've detailed in the next section.

10 Best Alternatives to Wallester

1. OneSafe

At OneSafe, we provide a finance platform designed to modernize banking for businesses, especially those operating in the Web3 and crypto sectors. Our platform offers essential tools for effortless fund management, quick payments, and access to both traditional and digital assets.

We enable direct 1:1 conversion from USD to USDC on Polygon, which simplifies payroll and expense management for global teams. Businesses also appreciate our streamlined onboarding, rapid account setup, and responsive customer support tailored for the digital asset space.

Pricing

Here's a look at our straightforward pricing:

- Free Account Services: We offer free account opening, maintenance, and card issuance, with no monthly subscription or minimum balance requirements.

- 0.1% US Domestic Transfers: This competitive rate applies to both ACH and standard wire transactions. Fedwire transfers have a flat $25 fee.

- Low International Fees: SEPA payments in EUR are just 0.2% per transaction, while international wires are 0.2% plus a $50 SWIFT fee.

- Competitive Crypto Fees: We charge a low 0.1% fee for USDT transactions, and our fiat-to-crypto conversions are included at market rates with no hidden charges.

- 3% Corporate Card FX: This fee applies to any spending on your corporate card in a currency other than USD.

Reviews

Clients consistently praise our exceptional customer support and our platform's ability to simplify complex financial operations, particularly for Web3 companies. Users find that our solutions effectively address major pain points in banking and payroll management.

- “OneSafe has the best customer support I've ever experienced from a bank.” — Amit Chu, Investments @ Celo Foundation

- “OneSafe is a game-changer. They solve so many headaches for our company. Finally a banking solution that gets it.” — Marco, CEO of Ensuro

Want to learn more? Check us out here.

2. Blank

Blank is a French company that provides online professional accounts designed for freelancers and small businesses. The service equips users with a French IBAN, a Visa Business card, and various tools for business management.

The platform includes features for automated Urssaf declarations, simplified accounting, and the creation of quotes and invoices. It also provides professional insurance options and access to partner offers to address different business requirements.

Pricing

Here's their pricing at a glance:

- €6 excluding tax per month Simple: Includes 30 SEPA transfers, quote and invoice creation tools, automated Urssaf declarations, and expense tracking.

- €17 excluding tax per month Confort: Includes all Simple plan features plus phone support (5 days a week), 30 additional SEPA transfers, higher card limits, and income maintenance insurance.

- €39 excluding tax per month Complète: Includes all Confort plan features plus unlimited SEPA transfers, email and phone support (6 days a week), and higher card limits.

Reviews

User feedback on Blank is varied, with some reviews pointing to difficulties with account closure processes and accessing funds. Check out more Blank reviews here.

3. RelayFi

RelayFi is a financial technology company that offers an online banking platform tailored for small businesses. The service provides a suite of tools intended to help companies manage their financial operations.

The platform enables users to open multiple checking accounts without fees or minimum balances and issue debit cards with built-in spending policies. It also integrates with accounting software like QuickBooks and Xero and supports the Profit First methodology for financial management.

Pricing

Here is a look at their pricing plans:

- $0 per month Starter Plan: This plan includes banking features, automated savings, and integrations with QuickBooks and Xero.

- $30 per month Grow Plan: This plan offers all Starter Plan features, plus multi-step bill approval rules and customizable bookkeeping automation.

- $90 per month Scale Plan: This plan provides all Grow Plan features, along with AI-powered automation, cash flow insights, and faster customer support.

Reviews

User reviews often mention the platform's interface, accounting software integrations, and support for the Profit First methodology, though some customers report transaction delays and inconsistent support experiences. Check out more RelayFi reviews here.

4. Soldo

Soldo provides a spend management solution that helps businesses organize and control their expenses. The platform uses a combination of an app and various payment methods to manage decentralized company spending.

It includes features such as real-time monitoring of multi-currency expenses, customizable user roles, and integration with accounting software. This setup allows employees to make purchases while the company maintains financial oversight, which can impact productivity and administrative workload.

Pricing

Soldo offers a tiered pricing structure, but specific details are not publicly available. The company provides a free trial, and interested parties must contact Soldo directly for complete pricing information.

Reviews

User feedback often comments on the platform's interface and expense management capabilities. Some users have reported issues with login access, statement delivery, and account closure, while customer support experiences appear to vary. Check out more Soldo reviews here.

5. Kontist

Kontist is a German financial service provider that offers business banking solutions for freelancers and self-employed individuals. The company provides users with a German IBAN and a physical Visa debit card.

The platform offers automatic tax estimation and real-time tax calculation to assist with financial planning. Users can also set aside funds specifically for tax payments, which helps with managing their financial obligations.

Pricing

Here's their pricing at a glance:

- Free Business Account: Includes a German IBAN, a physical Visa debit card, and real-time tax estimation.

- €11 per month plus VAT Start: Adds subaccounts and 30 SEPA transfers.

- €25 per month plus VAT Plus: Includes VAT return and business evaluation.

Reviews

Some user reviews mention issues with high fees, limited free transactions, and the responsiveness of customer service. Check out more Kontist reviews here.

6. Credem

Credem, or Credito Emiliano S.p.A., is an Italian banking institution established in 1910, with its headquarters in Reggio Emilia. The bank provides a range of services including retail and corporate banking, insurance, and investment solutions through its various divisions.

The institution operates with a distinct approach to collateral, accepting wheels of Parmigiano Reggiano cheese for loans. This practice is an example of its approach to banking operations.

Pricing

Credem's pricing structure varies by product, with account maintenance fees starting from €4 per month and investment services having custom pricing. While card issuance and withdrawals at Credem ATMs are free, detailed information on other services requires direct contact with the bank.

Reviews

User reviews mention issues such as delays in receiving debit and credit cards and a lack of digital card options. Some customers also report concerns regarding the responsiveness of customer service. Check out more Credem reviews here.

7. Anna Money

ANNA Money is a UK-based financial service provider that offers business accounts for small and medium-sized enterprises, freelancers, and creative professionals. The company provides tools designed to assist with financial management for these specific user groups.

The platform combines invoicing, receipt scanning, and tax calculations, and offers 24/7 customer support. Additionally, it facilitates expense tracking by matching receipts to transactions and enables bulk payments for payroll.

Pricing

ANNA Money's pricing is usage-based, with costs determined by the services a customer utilizes. The monthly fee starts at £0, and no charge is applied if the account is not used during a given month.

Reviews

User feedback often mentions the app's functionality and customer support, though some customers have reported issues with account suspensions and difficulties accessing their funds. Check out more Anna Money reviews here.

8. Payhawk

Payhawk provides a spend management platform that integrates corporate cards, expense management, and accounts payable into a single system. This setup is designed to enhance visibility and control over company expenditures through real-time tracking and reporting.

The service includes multi-currency Visa cards, automated receipt collection, and AI-powered data extraction in over 65 languages. Additionally, the platform supports multi-entity management, allowing businesses to oversee multiple subsidiaries within one account.

Pricing

Payhawk does not make its pricing structure publicly available. To receive pricing information, businesses must schedule a personalized demo.

Reviews

User feedback indicates a range of experiences, with some customers reporting challenges during the initial setup and a need for clearer explanations within the platform's administrative settings. Other reviews mention issues such as inconsistent user interface updates, mobile app synchronization problems, and occasional delays in transaction updates. Check out more Payhawk reviews here.

9. OneMoneyWay

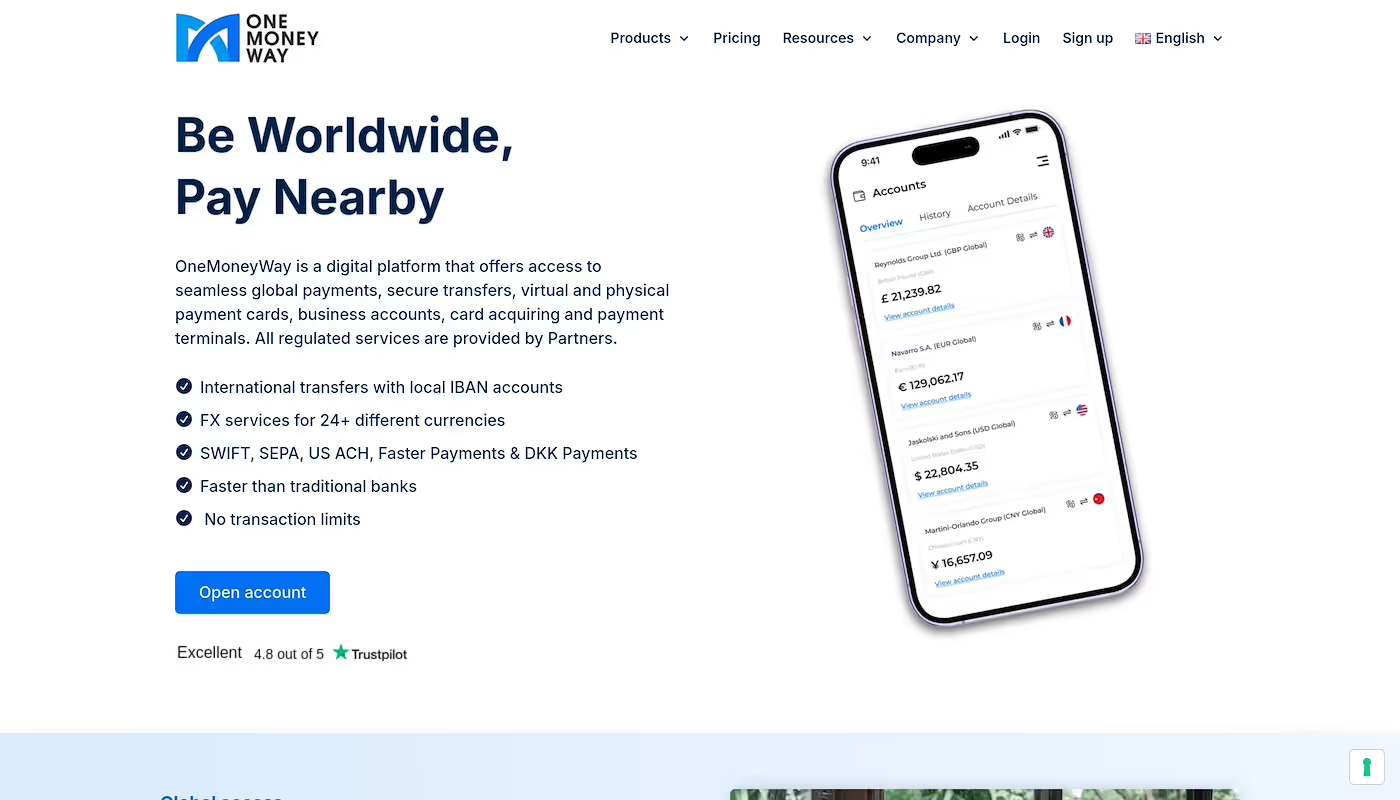

OneMoneyWay is a digital platform that offers global financial services for small and medium-sized enterprises in Europe. The company provides international transfers with local IBAN accounts, foreign exchange for over 24 currencies, and various payment solutions like SWIFT and SEPA.

The platform states that its transactions are faster than those of traditional banks and sets no limits on transaction amounts. It also provides virtual and physical corporate cards, business accounts, and payment terminals through its regulated partners.

Pricing

Here's their pricing at a glance:

- Free Freemium: For businesses with annual revenue below £150,000, this plan includes one business account, one virtual corporate card, and higher transaction fees.

- £49 per month Starter: Billed annually, this plan provides up to three business accounts, lower transaction fees, two virtual corporate cards, and two physical corporate cards.

- £99 per month Business: Billed annually, this plan offers up to five business accounts, the lowest transaction fees, unlimited virtual corporate cards, and four physical corporate cards.

All prices are indicative and depend on the company's revenue and industry.

Reviews

User reviews often comment on the company's service, staff interactions, and platform features like local IBAN accounts. Some feedback notes that processing times can be extended due to the thoroughness of the account setup process. Check out more OneMoneyWay reviews here.

10. Multipass

Multipass is a UK-based financial technology company that provides businesses with multi-currency virtual International Bank Account Numbers (IBANs) and corporate cards. Their services include local accounts in the EU, UK, and US, along with online banking capabilities.

The platform facilitates sending, receiving, and exchanging funds in over 70 currencies. Additionally, the company assigns dedicated relationship managers to its business clients.

Pricing

Multipass provides a pricing structure tailored to each business, with costs for onboarding, account maintenance, payments, and cards. For a complete list of fees and a specific quote, businesses are encouraged to contact Multipass directly.

Reviews

User reviews generally comment on the platform's reliability, international payment efficiency, and customer support. While a small portion of reviews are negative, specific details about these experiences are not available. Check out more Multipass reviews here.

Which One Should You Go With?

Choosing the right financial partner depends on your unique business needs, and any of these platforms could be a great choice. If you're looking for a modern solution tailored for global and crypto operations, we believe OneSafe stands out as an excellent alternative. Sign up for OneSafe today to see how we can simplify your financial management.