While Wise is a well-known name for international money transfers, some users have reported issues like account freezes and unresponsive support, leading them to seek other options. This article will delve into what Wise offers, the reasons you might consider an alternative, and other global payment solutions that could better fit your personal or business requirements.

What is Wise?

Founded in 2011, Wise is a UK-based financial technology company specializing in low-cost, transparent international money transfers. The platform provides a multi-currency account for holding over 40 currencies and a debit card for worldwide use.

Wise utilizes the mid-market exchange rate, operating on a pay-as-you-go model with no hidden subscription fees. This approach has drawn over 15.5 million customers, expanding services to include business and platform solutions.

What to Consider When Selecting a Wise Alternative?

Choosing the right financial platform depends on your specific needs. When searching for a Wise alternative, here are five key factors to evaluate:

- Fees and Exchange Rates: Scrutinize the fee structure and exchange rates to ensure you're getting the most value from every transaction.

- Global Reach and Currencies: Verify that the service supports the currencies and countries essential for your personal or business transactions.

- Business-Specific Tools: Look for integrated features like payroll processing, expense management, and accounting integrations to simplify your financial workflow.

- Crypto and Digital Asset Support: If you operate in the Web3 space, confirm the platform offers reliable fiat-to-crypto conversions, such as USD to USDC.

- Quality of Customer Service: Assess the provider's reputation for responsive and helpful support, which is indispensable when financial issues arise.

If these considerations strike a chord, the following section explores several platforms that might be a better fit for you.

10 Best Alternatives to Wise

1. OneSafe

At OneSafe, we provide a finance platform designed to modernize banking for businesses, particularly those operating in the Web3 and crypto sectors. Our goal is to simplify complex financial operations, offering a straightforward solution for both traditional and digital asset management.

We enable direct 1:1 conversion from USD to USDC on Polygon, which greatly simplifies payroll and expense management for global teams. Additionally, our platform ensures rapid account setup, frictionless transfers, and responsive customer support tailored for organizations in the digital asset space.

Pricing

We believe in transparent, straightforward pricing. Here’s a look at what you can expect when you partner with us:

- Free Account Services: We charge no fees for account opening, maintenance, or card issuance, and there are no monthly subscriptions or minimum balance requirements.

- 0.1% on US Domestic Transfers: Move funds within the US via ACH and standard wires for a low 0.1% fee per transaction. Fedwire transfers are a flat $25.

- From 0.2% on International Payments: Send money abroad with competitive rates—0.2% for SEPA payments in EUR and 0.2% plus a $50 SWIFT fee for other international wires.

- Transparent Crypto Fees: USDT transactions are just 0.1%, and our direct USD-to-USDC conversions are included with market rates, with no hidden charges.

- 3% on Non-USD Card Spending: A 3% foreign exchange fee applies to all corporate card transactions made in currencies other than USD.

Reviews

Clients consistently praise our platform for its exceptional customer support and ability to simplify complex financial operations, often calling our solution a game-changer that resolves major headaches in payroll and banking for Web3 companies.

- “OneSafe has the best customer support I've ever experienced from a bank.” - Amit Chu, Investments @ Celo Foundation

- “OneSafe is a game-changer. They solve so many headaches for our company. Finally a banking solution that gets it.” - Marco, CEO of Ensuro

Want a banking solution that gets it? Check us out here.

2. Ampere

Ampere is a UK-based financial services provider offering an all-in-one business account designed for startups and small to medium-sized enterprises. The platform includes multi-currency accounts and the ability to create invoices directly from the bank account.

It provides currency exchange at a 0.35% rate, business loans, commercial mortgages, and merchant accounts with acquiring fees from 0.65%. While some users find the app easy to use for managing multiple currencies, others have noted a need for more advanced business features and support for additional currencies like USD.

Pricing

Here's their pricing at a glance:

- £35 Setup + £20/month Business Account: The setup fee for UK residents covers the first month's maintenance and card issuance.

- £25 Setup + £10/month Private Account: The setup fee includes the first month's maintenance and card issuance.

- Free to £25 Transfers: Local transfers in GBP and EUR are free, while international SWIFT transfers cost £25.

- 0.35% Currency Exchange: A fee of 0.35% is applied to the exchange amount for GBP and EUR.

- Card & ATM Fees: Debit card issuance is £15, included in the setup fee, and ATM withdrawals have a 2% fee plus £1.50 per transaction.

Reviews

User feedback often centers on the platform's interface and multi-currency functions. Some customers have noted a need for more advanced business features, support for currencies like USD, and have reported issues with customer service responsiveness. Check out more Ampere reviews here.

3. RelayFi

RelayFi is a financial technology company that offers an online banking platform specifically for small businesses. The service is structured to assist companies in managing their financial operations through a suite of banking tools.

The platform allows users to open up to 20 checking accounts with no fees or minimum balances and integrates with accounting software like QuickBooks and Xero. It also supports the Profit First methodology with automated savings accounts and provides customizable debit cards with spending controls.

Pricing

Here's their pricing at a glance:

- $0/month Starter Plan: Designed for solopreneurs and new businesses, this plan includes banking features, automated savings with a 1.03% APY, and integrations with QuickBooks and Xero.

- $30/month Grow Plan: Intended for small teams, this tier offers all Starter Plan features plus multi-step bill approval rules, customizable bookkeeping automation, and branded invoices.

- $90/month Scale Plan: Aimed at larger teams, this plan includes all Grow Plan features along with AI-powered automation, cash flow insights, and faster customer support.

Reviews

User reviews often comment on the platform's interface, accounting software connections, and customer support, though some have reported transaction delays and account freezes. Check out more RelayFi reviews here.

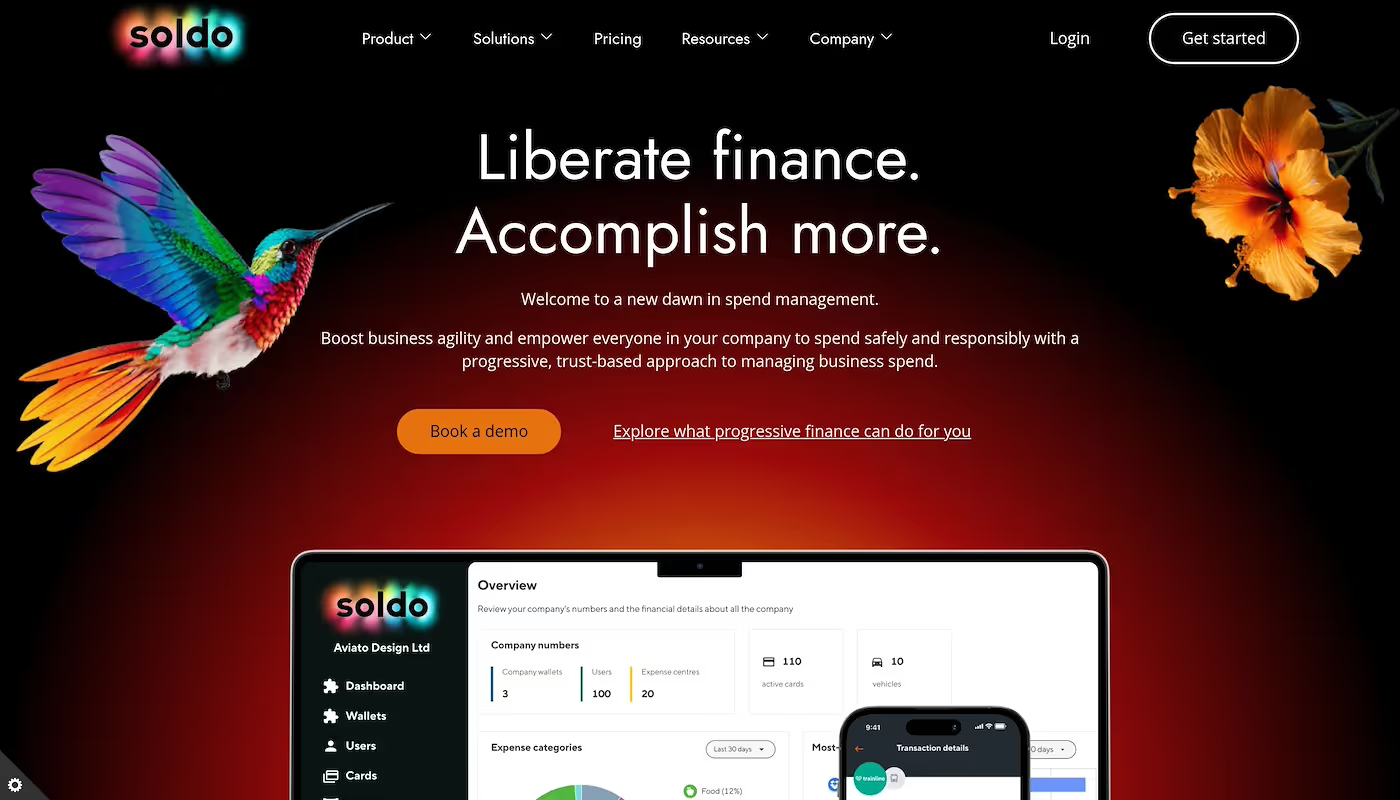

4. Soldo

Soldo is a spend management platform designed to help businesses organize and control their expenses. It provides a system that combines a user app with various payment methods to manage company-wide spending.

The platform includes features such as real-time monitoring of multi-currency expenses, customizable user roles, and integration with accounting software like Xero. This setup allows employees to make necessary purchases while the company maintains financial oversight, which can impact productivity and reduce administrative workloads.

Pricing

Soldo offers a tiered pricing structure, but the specific costs for each plan are not publicly available. The company provides a free trial period, and prospective customers must contact Soldo directly for detailed pricing information.

Reviews

User feedback indicates some customers have experienced issues with login access, statement delivery speed, and the account closure process. Opinions on customer support are varied, with some users reporting different experiences regarding response times and the quality of assistance. Check out more Soldo reviews here.

5. Payhawk

Payhawk is a spend management platform that integrates corporate cards, expense management, and accounts payable into a single system. This setup is intended to give businesses more visibility and control over company spending through real-time tracking and reporting.

The service provides Visa credit and debit cards in various currencies, along with automated receipt collection and AI-powered data extraction. It also includes features for managing multiple business entities and connects with accounting systems such as Xero, QuickBooks, and NetSuite.

Pricing

Payhawk does not publicly disclose its pricing structure. To obtain pricing information, prospective customers are required to schedule a personalized demo to discuss a plan tailored to their specific needs.

Reviews

User feedback indicates some have experienced issues with mobile app synchronization and transaction update delays, while others have noted challenges with the initial setup and a need for clearer administrative explanations. Check out more Payhawk reviews here.

6. Credem

Credem, or Credito Emiliano S.p.A., is an Italian banking institution founded in 1910 with its headquarters in Reggio Emilia. The bank provides a range of services including retail and corporate banking, insurance, and investment solutions through its various divisions.

A notable aspect of its operations is the acceptance of Parmigiano Reggiano cheese wheels as collateral for loans. This practice illustrates one of its distinct operational methods within the region.

Pricing

The pricing structure for Credem's services varies depending on the specific product or service, with account maintenance fees starting from €4 per month while card issuance is free. For detailed pricing on other offerings like investment services, it is advisable to contact the company directly.

Reviews

User reviews mention issues such as delays in receiving debit and credit cards, a lack of digital card options, and concerns regarding customer service responsiveness. Check out more Credem reviews here.

7. Brex

Brex is a financial technology company founded in 2017 that offers services like corporate credit cards, expense management, and business accounts through an integrated platform. This platform is designed for startups, mid-sized companies, and global enterprises to manage their financial operations.

The service provides AI-powered custom rules for spending, real-time reporting, and connects with various accounting systems. These functionalities are intended to give businesses more control over their financial management and cater to a range of company sizes.

Pricing

Here's their pricing at a glance:

- Free Essentials: This plan includes global card acceptance, AI-powered custom rules, accounting integrations, travel booking, bill pay, and reimbursements.

- $12/user/month Premium: Includes all Essentials features, plus multiple expense policies, advanced approvals, multi-entity support, and customizable ERP and HRIS integrations.

- Custom Enterprise: Includes all Premium features, with the addition of unlimited global entities, local card issuance, a named account manager, and custom implementation services. Pricing is determined based on specific requirements.

Reviews

User feedback often points to challenges with customer service responsiveness, international wire transfers, and the user interface, with some also noting difficulties in receipt syncing and expense categorization. Check out more Brex reviews here.

8. Reap

Reap is a financial technology company founded in 2018 that offers a suite of products to streamline financial operations for businesses. Its offerings include the Reap Card, a secured corporate credit card, Reap Pay for multi-currency payments, and API solutions for card issuing.

The platform facilitates bill repayments in both fiat and digital currencies and provides global coverage with spend controls. Additionally, it offers embedded finance options for businesses to automate global payouts.

Pricing

The Reap Card has no annual or hidden service fees, but there is a 1.2% handling fee for stablecoin repayments and a 2% fee for both ATM withdrawals and foreign exchange transactions. For businesses that want to launch their own card programs, Reap provides customized packages for card issuing and APIs, with pricing based on product usage.

Reviews

User reviews mention several concerns, including unannounced credit limit resets, issues with customer service, and questions about the company's financial standards. Check out more Reap reviews here.

9. Fiducial Banque

Fiducial Banque is an online banking institution established in 2014 to serve professionals, small to medium-sized enterprises, and associations. As a subsidiary of the Fiducial Group, it provides banking services that include business loans and leasing options.

Clients are assigned a dedicated advisor and can manage their accounts through a digital platform available 24/7. The bank offers tiered account packages that include services like Visa Business cards, SEPA transfers, and check deposit capabilities.

Pricing

Here's their pricing at a glance:

- €12 excluding tax per month PRO Base: This package includes a professional current account, a dedicated banking advisor, 24/7 online banking access, a Visa Business debit card, unlimited SEPA direct debits and transfers, and check deposit services.

- €25 excluding tax per month PRO Plus: This tier encompasses all PRO Base services, plus the ability to accept card payments from clients, a Visa Business debit card with immediate or deferred debit options, and checkbooks.

- €45 excluding tax per month PRO Excellence: This package includes all PRO Plus services, with the addition of unlimited account movement commissions, one free cash deposit per month through a partner network, and a Visa Premier debit card with deferred debit.

Reviews

User feedback indicates issues with customer service responsiveness, including delays in receiving assistance, alongside technical problems with the mobile application and system failures. Check out more Fiducial Banque reviews here.

10. Primis Bank

Primis Bank, originally Sonabank, was established in 2005 and rebranded in 2021. This Virginia-based institution offers a variety of banking services, including business and personal accounts, high-yield savings, and CDs.

The bank provides accounts with no monthly fees, overdraft charges, or minimum balance requirements, along with unlimited transactions. Additionally, customers have access to free business insights and 24/7 support from human representatives.

Pricing

Primis Bank does not publicly disclose a detailed pricing structure for its services. For specific information regarding account fees, interest rates, and other charges, it is necessary to contact the bank directly.

Reviews

User reviews indicate some customers have experienced long wait times for support, difficulties with account access, and unexplained denials for business account applications. Check out more Primis Bank reviews here.

Which One Should You Go With?

Navigating the world of financial platforms can be complex, and any of the alternatives listed can be a great choice depending on your specific needs. If you're a modern business looking for a platform that simplifies global payments and digital asset management, we believe OneSafe offers a uniquely tailored solution. Ready to experience a banking platform that just gets it? Sign up for OneSafe today.